FloodAssist® Reports will help you determine a property's flood zone, find other necessary flood data, and satisfy Federal Emergency Management Agency (FEMA) requirements. The following types of FloodAssist Reports are available:

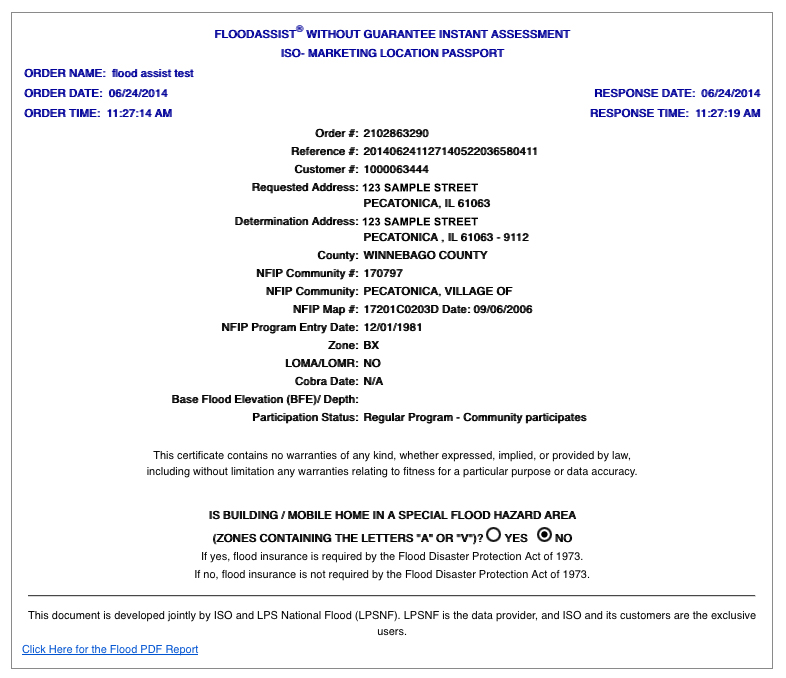

Instant Assessment (Automated) without Guarantee — an instant-response report, without guarantee of accuracy (personal property only)

Personal Property (Automated) with Guarantee — an instant-response report, with a guarantee of accuracy

Personal Property (Manual) with Guarantee — a manual search report (invoked when the system cannot determine the flood zone using the automated process), provided with a guarantee of accuracy

Commercial Property (Automated and Manual) with Guarantee — an instant-response report or a manual search, similar to the personal property reports with guarantee, but with higher FEMA insurance limits for nonresidential property

When you order a FloodAssist report with guarantee, Service Link National Flood, LLC (SLNF) will guarantee the accuracy of the returned flood determination data. With your guaranteed report, you will also receive a PDF of the completed FEMA Form 81-93 for the risk property.

SNLF is one of the largest and most experienced flood certification vendors, with over 25 years of experience, and is a National Flood Determination Association (NFDA) certified vendor.

The FloodAssist report provides the following information:

|

Order # |

A system-generated number assigned to each report ordered. |

||||||||||||||||||

|

Reference # |

A required, system-generated number used to track your order. |

||||||||||||||||||

|

Customer # |

Your customer identification number, determined at the time of account setup. |

||||||||||||||||||

|

Requested Address |

The customer’s address, as input on the New Order page. Entering addresses verified against United States Postal Service standards will improve the response rate and accuracy. |

||||||||||||||||||

|

Loan Identifier (Guarantee Only) |

A unique number that identifies the loan. Values are alphanumeric, with a maximum of 20 characters. |

||||||||||||||||||

|

Determination Address |

Displays the customer’s address after processing by a format-standardization tool to maximize response rate and accuracy. |

||||||||||||||||||

|

County |

The county in which the address is located. |

||||||||||||||||||

|

The number found in the FEMA Community Status Book. If no community number exists, this field is blank. |

|||||||||||||||||||

|

The name of the community in which the building or home is located. |

|||||||||||||||||||

|

A 9- or 11-digit number identifying the FEMA map that contains the home or building. |

|||||||||||||||||||

|

Date |

The date the NFIP map became effective. Provided as a measure of reliability, this date (also known as the NFIP Map Panel Effective/Revised Date or the Community Effective Date) lets you see how recently FEMA has updated the map to reflect current floodplain measurements. |

||||||||||||||||||

|

The date the community began participating in the NFIP program. |

|||||||||||||||||||

|

The flood zone. All flood zones beginning with the letter "A" or "V" are Special Flood Hazard Areas (SFHA) in which the Flood Disaster Act of 1973 requires flood insurance. Any other zones, such as B, C, D, or X, lie outside of a Special Flood Hazard Area. See "Flood Hazard Zones" for more information. |

|||||||||||||||||||

|

Contains the date of the last Letter of Map Amendment (LOMA) or Letter of Map Revision (LOMR) made in response to an inaccuracy on an NFIP flood map. If FEMA has not made such revisions or amendments, this field will contain the word "NO." Approximately one percent of all addresses requested in FloodAssist display a date in this field. |

|||||||||||||||||||

|

Indicates whether the building or home is part of a designated Coastal Barrier Resources Area. The field will contain the date of the designation or "N/A." The NFIP prohibits insurance for any structure built or substantially improved after the Cobra Date. |

|||||||||||||||||||

|

(BFE)/Depth |

The elevation shown on the Flood Insurance Rate Map (FIRM) for Zones AE, AH, A1-A30, AR, AR/A, AR/AE, AR/A1-A30, AR/AH, AR/AO, V1-V30, and VE. The value indicates the water surface elevation (in feet) resulting from a flood that has a 1 percent chance of occurring in any given year. |

||||||||||||||||||

|

Participation Status |

The type of NFIP program in which the property participates, either regular or emergency. The values returned for this are 01 -09. Descriptions for each value are described below.

|

||||||||||||||||||

|

HMDA Information (Guarantee Only) |

The United States Home Mortgage Disclosure Act (HMDA) requires financial institutions to maintain and annually disclose data about home purchases, home purchase preapprovals, home improvement, and refinance applications involving 1- to 4-unit and multifamily dwellings. This field provides relevant codes for the state, the county, the MSA/MD, and the CT. (i) MSA/MD stands for metropolitan statistical area/metropolitan division. An MSA is an area that has at least one urbanized area with a population of 50,000 or more, plus adjacent territory that has a high degree of social and economic integration with the core. A metropolitan statistical area containing a single core with a population of 2.5 million or more may be subdivided to form smaller groupings of counties called metropolitan divisions. CT stands for census tract. Census tracts are small, relatively permanent statistical subdivisions of a county. For most metropolitan areas (MAs) and other densely populated counties, local census statistical area committees designate census tracts following Census Bureau guidelines. |

||||||||||||||||||

|

Is Building / Mobile Home in a Special Flood Hazard Area? |

Indicates whether the property in question lies within a Special Flood Hazard Area (also known as the 100-year floodplains). It effectively reiterates the flood-zone information (contained in the Zone field) into a convenient "YES" or "NO" format. Lets you quickly see whether flood insurance is necessary. |

|

Zone A |

Zone A is the flood insurance rate zone corresponding to the 100-year floodplains determined by approximate methods in a Flood Insurance Study. Because the study does not include detailed hydraulic analyses for these areas, the report does not show Base Flood Elevations (BFE) or depths within this zone. Mandatory flood insurance purchase requirements apply. |

|

Zones AE and |

Zones AE and A1– A30 are the flood insurance rate zones corresponding to the 100-year floodplains determined by detailed methods in a Flood Insurance Study. In most cases, the report shows, at selected intervals, Base Flood Elevations derived from the detailed hydraulic analyses within these zones. Mandatory flood insurance purchase requirements apply. |

|

Zone A99 |

Zone A99 is the flood insurance rate zone corresponding to areas of the 100-year floodplain that will be protected by a federal flood-protection system where construction has reached specified statutory milestones. The report does not show Base Flood Elevations or depths within this zone. Mandatory flood insurance purchase requirements apply. |

|

Zone AH |

Zone AH is the flood insurance rate zone corresponding to areas of 100-year shallow flooding, with a constant water-surface elevation (usually areas of ponding), where average depths are between one and three feet. The report shows, at selected intervals, Base Flood Elevations derived from the detailed hydraulic analyses within this zone. Mandatory flood insurance purchase requirements apply. |

|

Zone AO |

Zone AO is the flood insurance rate zone corresponding to the areas of 100-year shallow flooding (usually sheet flow on sloping terrain), where average depths are between one and three feet. The depth should be averaged along the cross section and then along the direction of flow to determine the extent of the zone. The report shows average flood depths derived from the detailed hydraulic analyses within this zone. In addition, the report shows the Flood Insurance Rate Map (FIRM) alluvial fan-flood hazards. Mandatory flood insurance purchase requirements apply. |

|

Zone AR |

Zone AR is the flood insurance rate zone used to depict areas protected by flood-control structures (such as levees) under restoration. FEMA will consider using the Zone AR designation for a community if:

Mandatory purchase requirements for flood insurance apply in Zone AR, but the rate will not exceed the rate for an unnumbered Zone A if the structure complies with Zone AR floodplain-management regulations. For floodplain management in Zone AR areas, the property owner is not required to elevate an existing structure when making improvements to the structure. However, for new construction, the structure must be elevated (or floodproofed, for nonresidential structures) so that the lowest floor, including basement, is a minimum of three feet above the highest adjacent existing grade, if the depth of the Base Flood Elevation does not exceed five feet at the proposed development site. For infill sites, rehabilitation of existing structures, or redevelopment of previously developed areas, there is a three-foot elevation requirement regardless of the depth of the BFE at the project site. When the project is complete and the local project sponsor submits all necessary data to FEMA, the agency will remove the Zone AR designation and issue an NFIP map showing that the restored flood-control system protects against the 100-year flood. |

|

Zone D |

Zone D is the designation for areas that FEMA has not analyzed and where there are possible but undetermined flood hazards. Mandatory flood insurance purchase requirements do not apply, but coverage is available. The flood insurance rates for properties in Zone D are commensurate with the uncertainty of the flood risk. |

|

Zone V |

Zone V is the flood insurance rate zone corresponding to areas within the 100-year coastal floodplain that have additional hazards associated with storm waves. The Flood Insurance Study includes only approximate hydraulic analyses for these areas. Therefore, the report does not show Base Flood Elevations within this zone. Mandatory flood insurance purchase requirements apply. |

|

Zone VE |

Zone VE is the flood insurance rate zone corresponding to areas within the 100-year coastal floodplain that have additional hazards associated with storm waves. The Flood Insurance Study includes detailed hydraulic analyses for these areas. The report shows, at selected intervals, Base Flood Elevations within this zone. Mandatory flood insurance purchase requirements apply. |

|

Zones B, C, and X |

Zones B, C, and X are the flood insurance rate zones corresponding to:

The report does not show Base Flood Elevations within these zones. Mandatory flood insurance purchase requirements do not apply in these zones. |

For some addresses, an automated or computerized search of the NFIP flood maps cannot determine the flood zones. In those cases, either:

the address lies in an area near the border of two or more different flood zone designations

or

the system cannot find the address

If you have signed up for an automated service — such as Instant Assessment (Automated) without Guarantee or Personal Property (Automated) with Guarantee — and request a report that FloodAssist cannot complete with an automated search, the system generates a report similar to the following:

Any report with this message requires a manual search. Only full-service reports may use manual searches.

In the rare event that a manual search can't determine the flood zone of an address, ISO will request more information in the form of a “legal description” of the property.